Back in March, federal investigators blew the lid wide open on a fraud scheme perpetrated by a group of 50 high-profile parents who traded cash for their kids to get guaranteed places in some of the country’s top colleges. If you’re involved in California commercial real estate, your stomach might’ve dropped when you read the news, because most of the accused just happen to be bona fide real estate royalty.

Now that we’re a couple of months into the story (with plenty more to come, I’m sure), there are lessons to be learned.

Rules for thee, but not for me

Entitlement can lead you down a heck of a primrose path. One of the biggest names implicated in the scandal, Jane Buckingham, has a back catalogue of articles chiding parents of millennials for being too soft, and the millennials themselves for being spoiled and lazy. The irony couldn’t be more obvious. “Rules for thee, but not for me” sounds good, until you break the wrong rule and end up with felony charges.

Then, there’s the loss of trust in individual companies and brokers as a whole. Robert Zangrillo, the Miami-based developer implicated in the case, released a statement distancing his family’s involvement in the scandal from his business endeavors. No matter how true this might be, to the average person – and the average investor – it casts a shadow over the whole operation, and even the profession. If some of the top names in the business think they can get away with serious crimes, who’s to say they won’t try something underhanded in their business dealings?

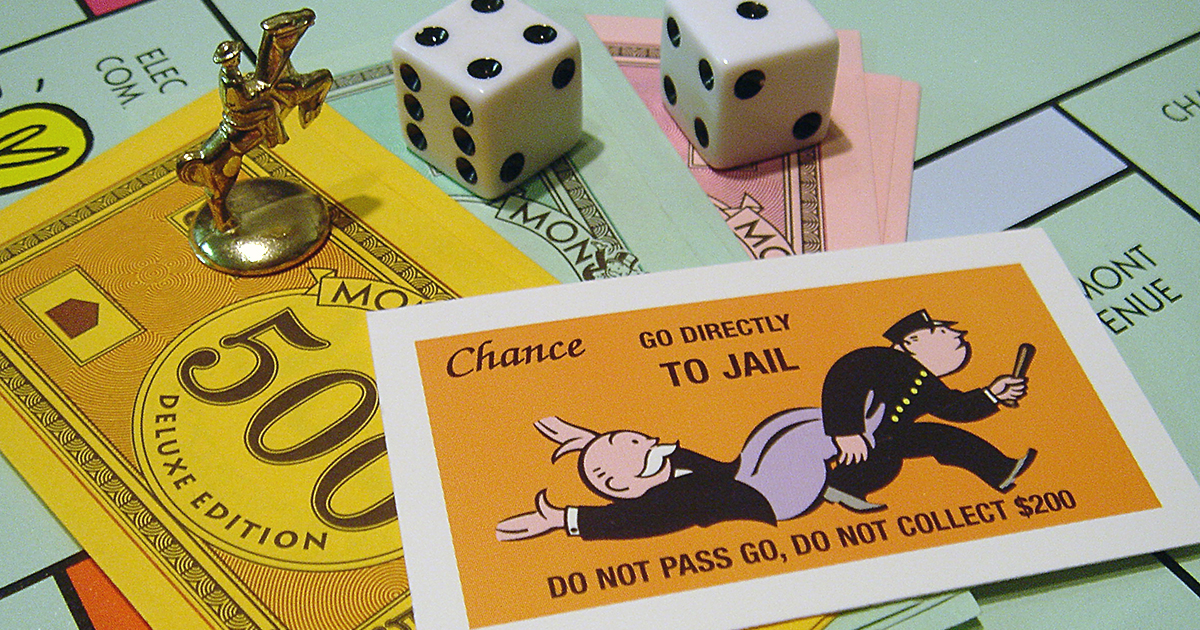

Some people think that being affluent comes with a get-out-of-jail voucher, AKA, their lawyer’s business card. But even the best lawyer can only do so much when the paper trail ends at your door.